An easy Help guide to The financing-Builder Loan

Credit builder loans are created to help you extend the borrowing from the bank record, improve your condition which have credit agencies, and grow your accessibility user lending products. Let us look closer during the just how short loans to simply help generate borrowing really works, if in case these are typically best for you.

What is actually A card Creator Financing And how Does it Let You?

It is possible to want to get a card creator financing just like the an effective way to lengthen your credit score and you may bolster your own borrowing rating when you have little to no credit score or a beneficial in earlier times damaged credit score that needs update. Like with an everyday auto, home loan, otherwise unsecured loan, a cards builder mortgage needs one to generate repaired repayments so you can their bank. Although not, according to the regards to a credit creator financing, you merely gain access to the degree of your loan in the the end of the latest loan’s label, after you have produced multiple fixed money with the bank. Because the good results to you, the financial accounts such costs in order to credit bureaus so you can introduce otherwise alter your borrowing from the bank.

- Borrowing creator fund you should never give you the loan amount upfront

- Rather, you create normal continual fixed payments for the the amount of the new mortgage, that you’ll supply at the end of the loan title

- These funds are often for sale in a small amount anywhere between $three hundred $a thousand

- Borrowing from the bank strengthening loans establish a minimal risk for loan providers while they wanted cash advance payday loan online borrowers to make most of the needed costs before accessing the bucks

- One payments you create are claimed by your financial to various credit agencies, and therefore helping you offer your credit score

Other choices To construct Borrowing

Naturally, borrowing strengthening financing commonly your own sole option when you need to enhance your credit history otherwise expand on your latest credit score. Option ways to consider are protected handmade cards, becoming a 3rd party representative into a pal otherwise nearest and dearest member’s borrowing from the bank account otherwise delivering an unsecured loan.

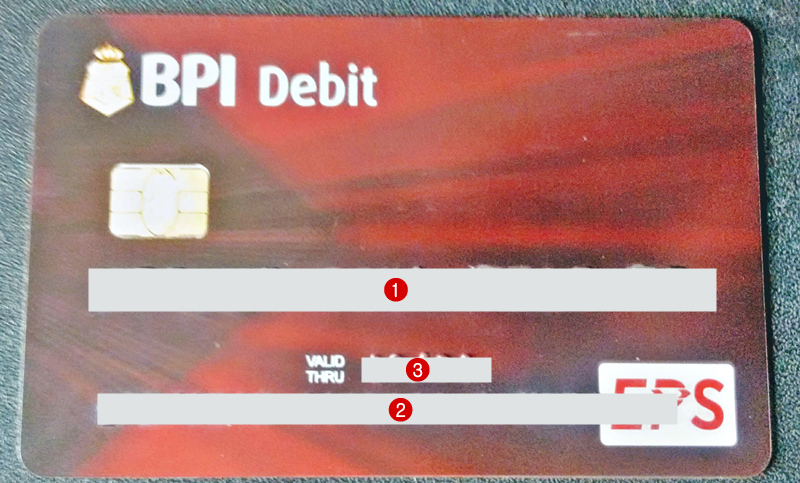

A guaranteed Credit card

A guaranteed bank card will be based upon an initial cover deposit (normally refundable), and offer your usage of a credit line within the similar trend to help you an unsecured charge card. Safeguarded bank card activity is usually reported in order to charge card bureaus, and certainly will make it easier to alter your borrowing from the bank, for as long as you will be making monthly minimal costs punctually and you can keeping up with debt loans. This means that: A secured bank card also offers all the advantages of a regular bank card, but banks want a security put to start this new membership. Before you apply for one, definitely see if their coverage deposit is actually refundable and you will whether or not there can be a yearly commission connected.

Rating Additional As A third party Affiliate

Family unit members, household members and you may family relations helps you make your borrowing from the incorporating your as the a third party affiliate to their bank card account, as long as the credit card provider profile such as for example passion to credit agencies. Inside circumstance, you would be able to make orders towards shared cards, nevertheless the top cardholder is motivated and you will guilty of and come up with payments. For people who skip repayments, new cardholder’s credit rating you’ll suffer. For as long as repayments manufactured for the in control fashion, it shared craft can help you continue your credit history.

Get A personal loan

Even although you have limited or less than perfect credit, you may qualify to track down a protected unsecured loan. Secured personal loans require some types of guarantee, such an auto or other goods of value, to reduce exposure for the lender or even pay-off the loan. So long as it report loan pastime to at least one of around three biggest credit reporting agencies at minimum, various personal loan affairs also may help you create your credit.

Where you might get Credit Builder Fund

Credit creator loans commonly constantly offered thanks to big financial business. As an alternative, you need to consult with borrowing from the bank unions and you may neighborhood finance companies.

The best way to Play with Funds from A card Builder Loan

Essentially, it is to build borrowing from the bank. not, using money from a card builder loan normally a fantastic way to present a crisis approximately-titled wet time fund. This allows your loan in order to build borrowing while also allowing you to uphold finance to possess unanticipated things.

The bottom line: Consider Whether A card Creator Financing Is your Best choice

Borrowing from the bank builder financing will not only bring a lot more access to investment, they also make it easier to extend your credit score and you may credit history. At the same time, also they are normally limited in range and you may buck count, and best booked having reason for helping you increase credit and you may present a crisis finance. While searching for borrowing from the bank expansion or improve, remember you have got other choices also.

Trying to find obtaining a consumer loan? You can find exactly what options are made available from Rocket Finance SM versus affecting your credit score now.