Disbursement is the transfer out-of mortgage funds from a lender otherwise You

The production of your responsibility to settle a percentage or every of your own finance. Your part of your loans which might be released:

- So long as be required to pay brand new piece one was discharged,

- You happen to be qualified to receive a refund off repayments you have got generated, and

- We'll report the release to consumer revealing businesses.

FAFSA is the form people need to over to try to get federal economic assistance, for the majority of state has and you can scholarships, and of a lot college-founded student educational funding software.

This is the rates where attention accrues in your college student loan

Individual loan providers (banking companies, borrowing unions, deals and loan contacts) offer money for FFELP Finance, plus the government pledges him or her facing default. FFELP has sponsored and unsubsidized Stafford Finance, Also Money to help you parents from mainly based pupils, And Finance to graduate and you can elite college students, and you can Combination Fund.

A grants or scholarships observe, also called an offer page, was an approach to alert individuals of your educational funding are considering, for instance the style of (has, grants, loans, and other programs) and number of aid.

We would collect, have fun with, and you can share Customer Pointers

3. The attributes accessible from Software which are readily available toward Application Web site and other internet out of ours (Services Websites).

Authorities is sold with any official, management, public otherwise regulating body, one authorities, any Taxation Expert, ties otherwise futures replace, courtroom, main financial or the police body, otherwise any of the agencies having jurisdiction over Increase.

Conformity Personal debt function loans away from Improve so you can adhere to: (a) Regulations or in the world information and you will inner principles otherwise tips, (b) one consult from Government or reporting, revelation or other obligations below Guidelines, and you can (c) Statutes requiring me to verify the name of our own consumers.

Exactly how getting married influences debt, taxation and you will credit

Combining lifestyle means merging financial points, even if you keep bank accounts separate. Different people brings with the matchmaking her credit history, which you'll is college loans or other debt.

Prior to your wedding, it is preferable to examine your bank account along with her generally there will not be people shocks. This can in addition to assist you in deciding how-to arrange for coming costs, as well as settling financial obligation.

How do college loans feeling relationship?

According to Forbes, student loan obligations 's the 2nd-highest personal debt classification in america. Over 44 billion Americans features student loan financial obligation. You'll be able to that you will be marrying someone with education loan debt, or you possess student loan financial obligation yourself.

Even if the personal debt is in one single person's title, it does nonetheless connect with one another people. That is because money needs to be assigned every month to help you investing regarding one loans, and the processes usually takes big date, depending on how much you owe and the amount of the new financing name. Using that cash straight back influences your hard earned money disperse and you may deals.

An enthusiastic 80-10-10 home loan is a loan in which earliest and you can 2nd mortgages are gotten while doing so

The original financial lien is pulled having an enthusiastic 80% loan-to-worth (LTV) ratio, which means that its 80% of your residence's costs; another home loan lien has a beneficial 10% LTV ratio, additionally the borrower makes a good ten% down-payment.

Trick Takeaways

- An 80-10-10 mortgage is actually organized having one or two mortgages: the first becoming a predetermined-rate loan at the 80% of one's residence's prices; another becoming ten% once the a home security loan; and remaining 10% as a funds down payment.

- This type of financial scheme reduces the down-payment off a great household without paying personal mortgage insurance (PMI), providing borrowers obtain property more readily towards the upwards-front will set you back.

- Yet not, borrowers commonly deal with apparently big monthly home loan repayments and will come across highest costs due into the changeable loan in the event that rates of interest improve.

Skills a keen 80-10-ten Mortgage

???????When a prospective citizen buys a home with lower than the fundamental 20% deposit, he is necessary to shell out individual home loan insurance (PMI). PMI try insurance you to definitely protects the bank lending the cash up against the chance of the latest debtor defaulting into the financing. An 80-10-ten financial is frequently employed by consumers to eliminate spending PMI, that will create a beneficial homeowner's monthly payment higher.

Typically, 80-10-10 mortgage loans are preferred in some instances whenever home prices is actually quickening.

Apply for Label Financing Online From inside the Atlanta Georgia

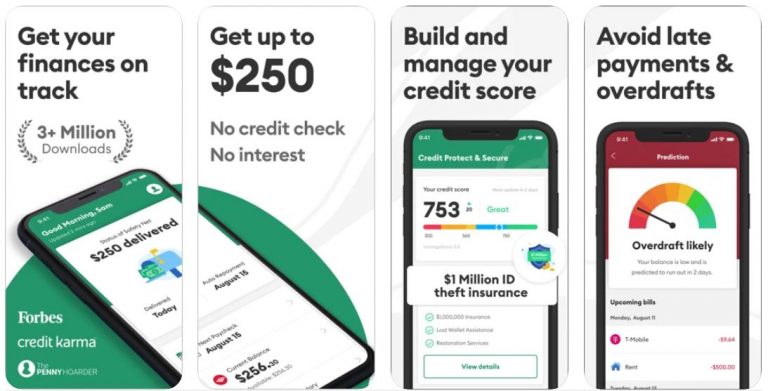

When you're searching for quick cash, either the simplest way from it will be to pull out a concept financing. Accredited borrowers can perhaps work with Name Pawn Online and to help you cash which can perhaps you have on your own feet in this times. The good thing is that you could qualify for money even which have less than perfect credit or no borrowing whatsoever.

It generally does not bring far to discover the best cost and you may conditions having a motor vehicle title mortgage inside the Atlanta Georgia. Incorporate on the web to find out exactly how much you can buy or talk with all of us physically discover an exact same time vehicle label mortgage. We offer as much as $25,one hundred thousand to have name financing into the Atlanta while do not require good credit so you can be considered!

What is actually Necessary to Score An auto Term Loan In Atlanta

The requirements are pretty straight forward, you simply need a definite term towards vehicle otherwise truck and you may an energetic family savings. The car term has to be on your title and also you have to have arms of it. Essentially, any covered bank from inside the Georgia desires know that you truly very own the car and do not possess unlock funds or liens that normally impede their financing approval.

It takes only a couple of minutes and does not apply to your own borrowing from the bank rating

Capital in the correct manner

Affirm does not costs costs and you also will never be penalized for investing the loan from early. Yearly percentage rates are normally taken for 0-30%.

Payment You Handle

Get the amount of months you may like to create money more in addition to matter you may like to spend per month. You are in manage.

Affirm pricing helps you pay money for stuff need more than date. You're in power over just how long you create monthly installments and you can how much cash you can easily spend.

You'll want to do an account on the internet and tend to be a cuatro-finger PIN which was texted to the cellular phone. Proceed with the prompt and ask for that loan. Give Affirm your location looking and how much money you you want. Upcoming, you'll see your loan choice.

You should be no less than 18 years of age. The fresh exclusions are in Alabama and several instances during the Nebraska in which you really must be 19 yrs . old getting noticed qualified. Register and create a free account to see if your qualify.

We wish to start by an apology. Our company is disappointed you wouldn't getting accepted today. Look at the email having a detailed effect out-of Affirm. If you fail to discover the email be sure to read the address which is inserted into the Affirm account.

Your ount of your item. If this is the scenario, you'll be needed to generate a down-payment. After this is completed, the monthly payments begins and become owed at the same time, undertaking on the 30 days once your loan are signed.

Sometimes, you happen to be requested so you can hook up your own savings account.

CECLs Implications having Financial Earnings, System Balances, and you can Economic Gains

Of the Cristian deRitis , Dr. Deniz Tudor

On this page, we learn the potential negative effects of after that CECL laws and regulations on the loan providers and you will speak about this new impact of CECL below various other Moody's Analytics circumstances. An improperly timed changeover may lead to an industry-wide liquidity lack otherwise an urgent situation into the monetary hobby. We offer suggested statements on the way the changeover so you can CECL can be managed effortlessly to possess minimal monetary perception.

The brand new option in accounting laws to help you a recent questioned credit losings (CECL) structure is meant to increase balance regarding economic climate and you may raise exchangeability regarding economic cycle.

cuatro. Keeps An effective Va House Assessment Completed

- Released people in brand new Selected Reserve need certainly to fill in a copy out of their yearly Old age Things Statement including proof respectable provider and discharge.

- Thriving partners you to dont found dependence benefits must fill in its partners DD Function 214, its relationship permit, as well as their partners dying qualification, including a duplicate regarding Va Out-of 21P-534-Are.

- Enduring partners exactly who receive dependence gurus must printing and completed Va Form 26-1817.

You can buy the COE from eBenefits site otherwise send your write-ups and you will a finished Virtual assistant Form twenty-six-1880 to the Department away from Veterans Products.

Virtual assistant Financing Restrictions

There are not any particular Virtual assistant loan limits, but it's as much as your own lender just how much you could obtain. Of numerous lenders require you to stick to the conforming financing restrictions . This means, inside the 2022, according to this type of limitations, you will possibly not acquire over $647,two hundred, however, one number may be high if you reside for the a high-costs town.

Entitlement benefits can perhaps work to your benefit. Entitlement 's the amount you may have available for a guaranty with the that loan. Those with complete entitlement don't keeps limits more home loans of $144,100000. For folks who default on the financing over $144,one hundred thousand, this new Virtual assistant will pay the financial to 25% of the amount borrowed.

- You've never utilized your house financing work with or

- You've paid back a previous Virtual assistant financing entirely and you may marketed the latest assets otherwise

- You put your house mortgage benefit however, paid the cash inside full when you underwent a short selling otherwise foreclosure.

Understanding The reasons why you Can be Declined for a financial loan

It finally took place-the thing monetary advisers commonly warn people regarding the-an emergency features arisen that is certain to give you beyond your own form financially. Perhaps the car have divided and requirements a life threatening resource to repair, or perhaps you might be experience a loss of income from your own mate getting laid off. If you like currency now however, can't score that loan, that is extremely stressful and you may perception more than simply your financial health www.cashadvancecompass.com/payday-loans-az/tucson.

Should this be your state, there is absolutely no cause to be embarrassed. In fact, a study awarded by BankRate stated that 56% off Us americans would have issue level a $1,100 crisis expenses having savings. It means they will certainly need to take a charge card, borrow cash out of a relative, otherwise have fun with an instant payday loan to cover the expense.

If this state arises, you can go into strive otherwise journey setting. A lot of people where thirty five% was caretakers otherwise thoughts away from home. No matter what the need otherwise number, an individual demands cash punctual due to an unforeseen scenario, they need usage of reasonable and you can caring lending. But not, that opportunity will not usually establish itself. When a household are declined the loan requests for almost all reasons, it's easy to become frustrated.

On the bright side, BrightUp concentrates on uplifting communities one sense traps in order to financial health with studies and you can info.

For additional info on Shariah-Certified money comprehend the Pointers and Guidance Provider Student loans and Shariah laws web page

The fresh new findamasters site teaches you exactly how much Postgraduate Master's Mortgage is obtainable for college students of Wales, Scotland and you may North Ireland that are reading in the united kingdom. Along with check out Scholar Money Wales, Pupil Honors Company Scotland and you will Scholar Funds north Ireland.

When you have gone to live in England off Scotland, Wales or North Ireland otherwise internd to move to help you England including look at the recommendations inside our Qualifications area particularly for students out of Scotland, Wales and Northern Ireland.

Shariah-Certified Financing

Islamic Sharia rules prohibits 'Riba', meaning that brand new purchasing and getting of great interest getting cash. The fresh new prohibition is usually used on excessively or unreasonable appeal but often is considered to add the economical interest reduced into an expert and you will Career Invention Mortgage, Student Money financing, financial overdraft or bank card.

Other Loans

Almost every other bank, private and you will pay check financing financing appear. They could have a look attractive but their small print such as higher interest rates or instantaneous payments makes him or her an inappropriate for college students.

A credit card is an additional particular mortgage which enables you so you're able to borrow funds. If you do not repay the balance completely each month, it'll cost you appeal. However, there are a couple of 0% desire and equilibrium import has the benefit of, there's undetectable fees such as transfer charges too since highest rates since the offer period stops. Always check the new small print before you take a charge card and make certain do you know what the speed are, how you will spend the money for money and you may what you will getting charged if you can't make the minimal monthly fees.